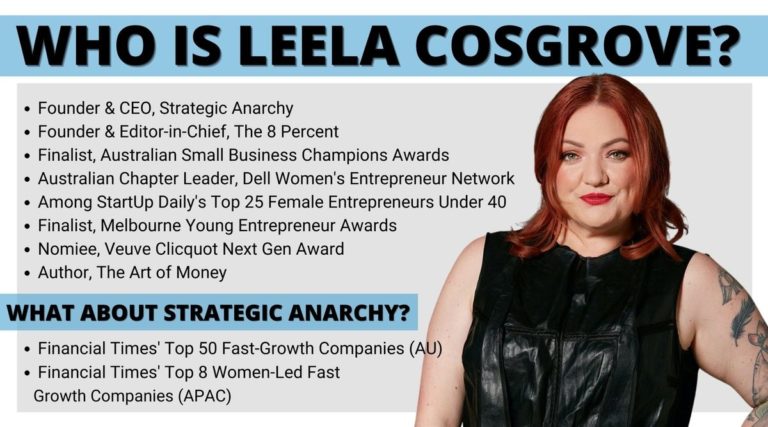

Bubbly, approachable and still shy of 45, Leela Cosgrove breaks the mould of traditional CEOs. But she’s clearly a force to be reckoned with.

With a background in copywriting, Cosgrove has managed to build a multi-million-dollar consulting business, Strategic Anarchy, and has partnered with the likes of Hermès, Deloitte and Virgin Australia.

She has given TED talks, claimed countless industry awards and is a certified media darling. So why are we talking to her about business cards?

Well, Cosgrove is a self-confessed fangirl regarding business cards and specifically American Express. Used responsibly, she says they can be an affordable and effective business tool. Here’s what she had to say about business cards and how they can help.

👋 We've partnered with American Express to bring you this interview. Since Leela Cosgrove uses an American Express Qantas Business Rewards Card, we'll use that as the example throughout. However, you should always research and compare your options.

Cash flow

No matter how successful an organisation is, poor cash flow can easily bring it to its knees. It’s an issue that inflicts some industries more than others, which Cosgrove experienced first-hand when she expanded her business empire last year.

“For us, in our consulting business, managing cash flow has been easier because clients are recurring and they pay us upfront for the month,” she told Finder. “But the ecommerce business I purchased last year is completely different.”

Cosgrove’s most recent business venture involves subscription boxes. She has to buy all of the stock, package it and have it ready to go before any money starts to roll in.

All up, it costs around $18,000 to $20,000 to fully replenish inventory. It’s an expense that Cosgrove regularly puts on her American Express Qantas Business Rewards Card, which offers card members up to 51 days to pay for purchases1.

“Having extra days means I can buy my inventory, charge my clients, then use that money to put back on the card,” said Cosgrove. “It makes life much easier knowing I have access to that money and that it’s interest free for that period.”

Employee expenses

Beyond helping with cash flow, Cosgrove says her business cards have helped with tracking employee expenses. Since she has an American Express Qantas Business Rewards Card, Cosgrove can apply for up to 99 complimentary employee cards2.

“All of my employees know to use the Amex Card first,” she told Finder. “Everything automatically goes into Xero and it makes it easy to see who’s spending what and where.”

It also makes life easy for Cosgrove’s accountant and bookkeeper who can see instant feeds of card transactions alongside bank account statements.

“They do the numbers and just send me the bill for the BAS quarterly,” said Cosgrove. “There’s no admin, which used to be the bane of my existence.”

Points

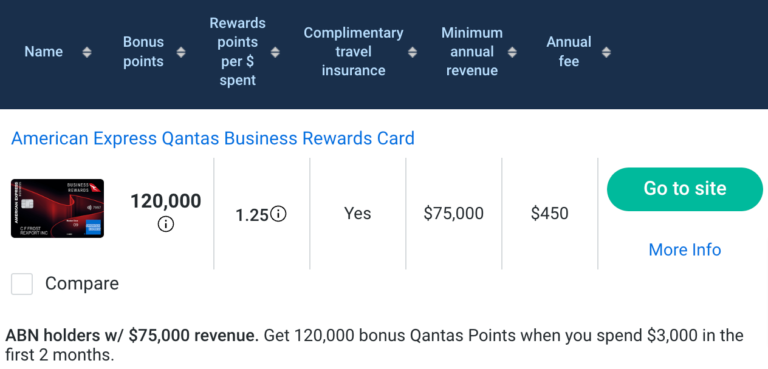

Unsurprisingly, points are also a big draw for business cards. Cosgrove’s American Express Qantas Business Rewards Card lets card members earn up to 1.25 Qantas Points per $1 spent on everyday business expenses3.

These can then be redeemed for a whole raft of different goods or services, covering everything from kitchen appliances and home tech to flights and spa experiences. Other rewards cards may have their own points systems or loyalty programs.

Cosgrove recently used her Qantas Points for a new work laptop that would have cost close to $4,000 but was instead on offer for 400,000 points. She also used 127,000 points to slash the cost of a trip to Fiji, bringing the overall price down from roughly $11,000 to $3,000.

Compare business cards from American Express

1 You can extend your cash flow by up to 51 days depending on your method of payment, when you make a purchase, when your statement is issued and whether or not you are carrying forward a balance on your account from your previous statement period. If you pay by direct debit, your payment will be processed 10 days after your statement is issued.

2 American Express approval criteria applies to employee cards. Fees and charges may apply. The Business, the Basic Card Member and each Employee Card Member are jointly and severally liable for all Employee Card spending.

3 Your business will earn 1.25 Qantas Points per $1 of eligible everyday spend, 0.5 Qantas Points per $1 spent at participating merchants classified as utilities, government or insurance, 2 Qantas Points per $1 spent on the eligible Qantas Products and Services. Exclusions apply. Subject to the Qantas Business Rewards Terms and Conditions and to the American Express Qantas Business Rewards Card Points Terms and Conditions.